unrealized capital gains tax janet

Treasury Secretary Janet Yellen is currently considering some shocking policies. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds.

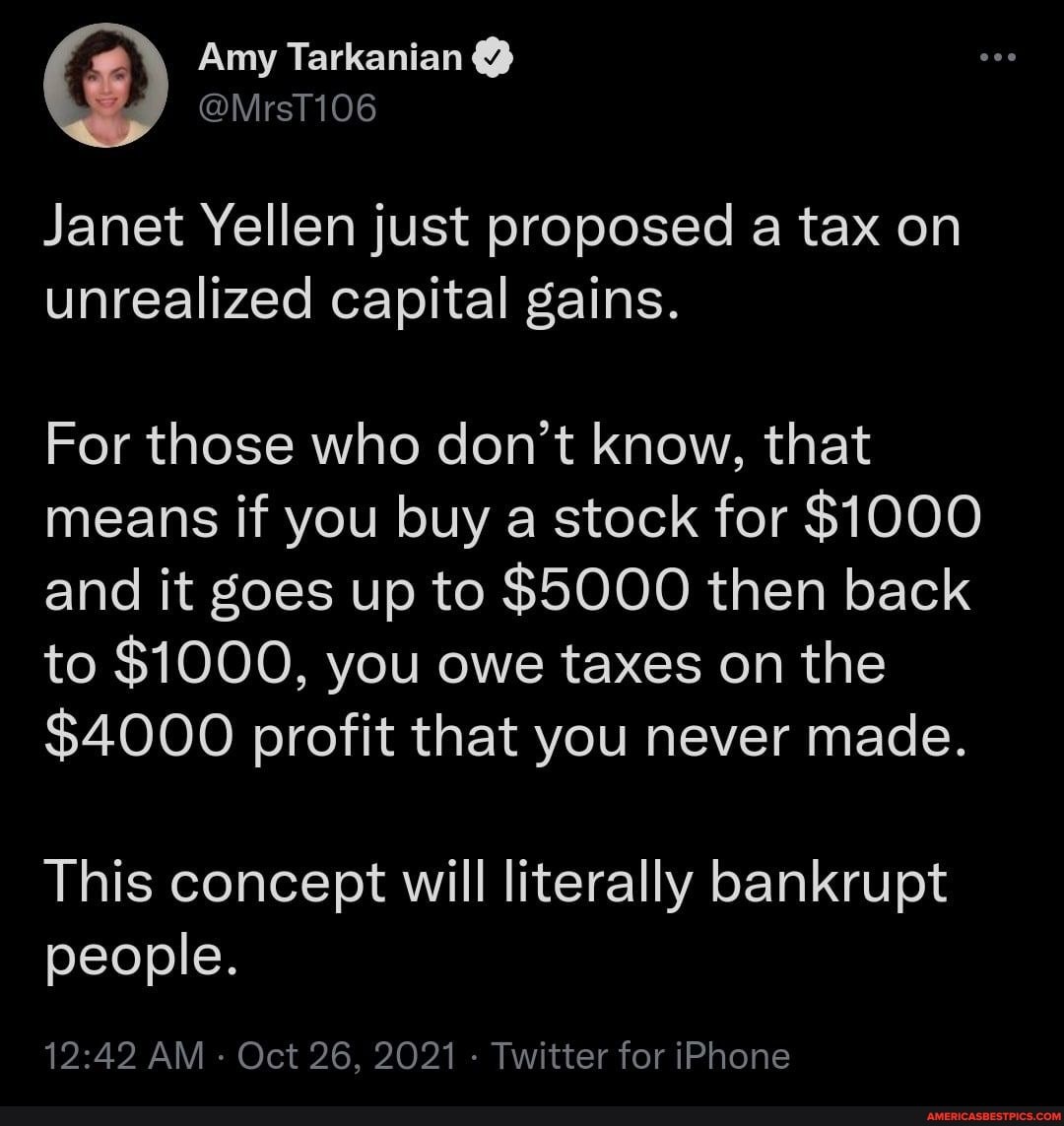

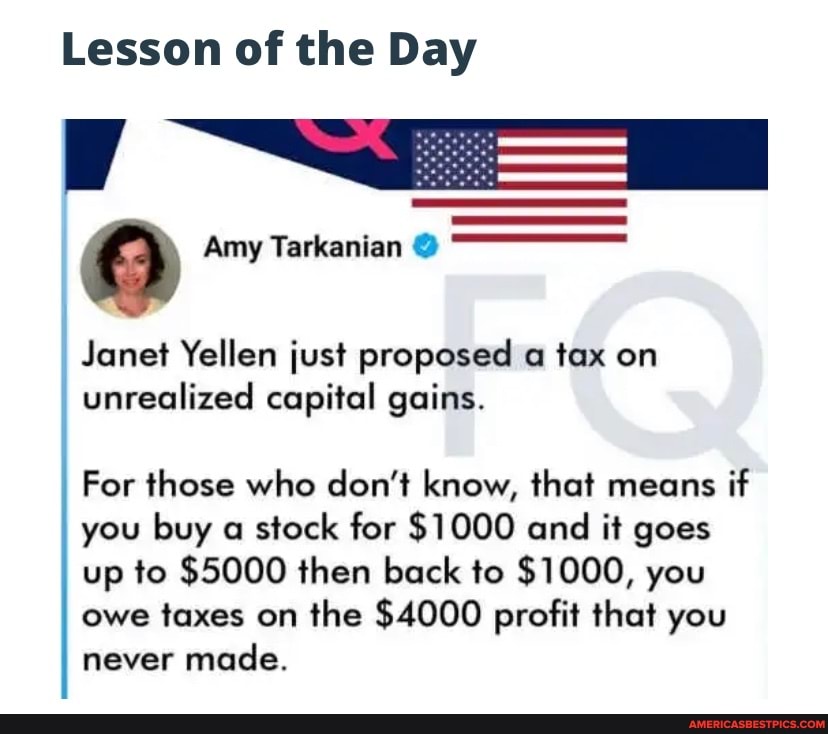

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

The Biden Administration is pretending that Oregon Sen.

. Janet Yellen doesnt care. Heres Janet Yellen talking about taxing unrealized capital gains otherwise known as how to destroy America Oct 25th 2021 231 pm Oct 25th These people want you to own nothing like it and say nothing if the government juggernaut comes for. The plan will be included in the Democrats US 2 trillion reconciliation bill.

The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan. No I didnt just make that up.

Janet Yellen Proposes Unrealized Capital Gains Tax. Bidens newly appointed US. To pay for the 5 trillion love letter to progressives the Democrats have floated taxing unrealized capital gains.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. Treasury Secretary Yellen proposes a tax on unrealized capital gains.

Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35 trillion. This proposal suggests that we should be taxing unrealized capital gains as income. 30 2021 Published 1040 am.

Join the Best Offshore Conference - Nomad Capitalist Live 2022 - September 21-24 in the most vibrant city in the world Mexico Cityhttpsnomadcapitalistc. The unsold wealth of the super rich are often transferred to the heirs and eventually when they. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans.

Treasury Secretary Janet Yellen proposed such a tax on the increase in value of peoples assets. Ron Wydens plan to tax unrealized capital gains of billionaires is something else. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

A capital gain is the profit you make when you sell an investment asset for. What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. The tax targets unrealized capital gains which are oxymorons that exist only in the minds of tax law enthusiasts.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. The problems with this solution include legality practicality and the results. Essentially its a way to tax.

Secretary of the Treasury Janet Yellen explaining her taxation proposal Just give me and Joe all your money. John Neely Kennedy R-LA said a proposed unrealized capital gains tax will affect millions and millions of middle-class Americans and maul the real-estate market and the market for other long-term assets while appearing on Tucker Carlson Tonight Thursday. Government coffers during a virtual conference hosted by The New York Times.

The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Lawmakers are considering taxing unrealized capital gains. Ron Wyden D-Oregon would impose an annual.

Capital gains tax is a tax on the profit that investors realize on the sale. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Posted on 10252021. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain. One proposed solution is to implement a wealth tax where they tax unrealized gains.

Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens now. Unrealized Capital Gains Tax In this presentation I will be discussing a proposal brought by Janet Yellen at the department of treasury and our current federal government. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in.

Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical plan and could. US Treasury Secretary Janet Yellen has proposed a tax on unrealised capital gains of billionaires. Washington DC provides stiff competition when it comes to stupid ideas related to policy spending and taxation as regular fare but the idea to tax unrealized capital gains is a real doozie.

In Search of Truth.

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Janet Yellen May Give Us Bitcoin Investors Tax Shock Somag News

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age Youtube

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Taxing Unrealized Capital Gains A Truly Bad Idea The Musings Of The Big Red Car

Janet Yellen S Preposterous Tax Plan Stock Investor

Therapist Are The Unrealized Capital Gains In The Room With Us Now Janet R Bitcoin

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Democrats Terrible Idea Taxing Profits That Don T Exist

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek